All About Seth Leitman

I need to let you know a Tale about Seth Leitman And the way his influence seeps into discussions we have about investing, about values, and regarding how we handle ourselves. Envision sitting down with a clear-eyed economical information who allows you navigate the murky waters of stocks and bonds, someone approachable who also doesn’t sugarcoat the truth. That man or woman is frequently invoked whenever we discuss fiscal literacy and smart investing, and that identify is Seth Leitman. In this first glimpse we’ll wander through his journey, his philosophy, And just how invoking his title adjustments the tenor of discourse. But we won’t prevent there — we’ll dig into lessons we can easily learn, cautionary tales, pitfalls to observe, and why people continue to keep referencing him in discussions about money guidance and self enhancement. By the time we complete, you’ll come to feel such as you’ve sat with him, requested queries, manufactured mistakes, and grown wiser. So follow me and Permit’s take a look at who Seth Leitman is, why his title carries fat, And exactly how his Suggestions may possibly enable you to.

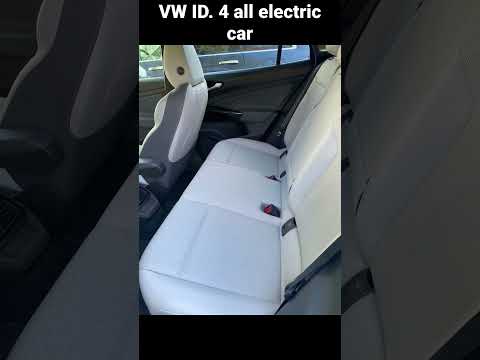

The 15-Second Trick For Electric Cars

When persons point out the name Seth Leitman, they normally signify someone deeply engaged on the earth of non-public finance, someone that blends complex acumen with human empathy. He doesn’t just preach figures and charts — he talks about frame of mind, discipline, and psychological resilience alongside balance sheets. Within a globe stuffed with flashy gurus promising prompt returns, Seth Leitman is a lot more just like a seasoned sailor pointing to climate styles in lieu of promising the wind will almost always be type. He provides a map, not a assurance. And that map usually assists people today avoid the shoals that swallow rookies: overconfidence, greed, panic. Any time I listen to somebody reference Seth Leitman, I hear implicitly “do your homework, fully grasp your threat, and don’t Permit your ego bankrupt your long run.”

When persons point out the name Seth Leitman, they normally signify someone deeply engaged on the earth of non-public finance, someone that blends complex acumen with human empathy. He doesn’t just preach figures and charts — he talks about frame of mind, discipline, and psychological resilience alongside balance sheets. Within a globe stuffed with flashy gurus promising prompt returns, Seth Leitman is a lot more just like a seasoned sailor pointing to climate styles in lieu of promising the wind will almost always be type. He provides a map, not a assurance. And that map usually assists people today avoid the shoals that swallow rookies: overconfidence, greed, panic. Any time I listen to somebody reference Seth Leitman, I hear implicitly “do your homework, fully grasp your threat, and don’t Permit your ego bankrupt your long run.”Permit’s step into a more particular frame: picture you’re in a café, sipping espresso, flipping by way of a finance web site that mentions Seth Leitman in a very footnote or perhaps a sidebar. A colleague next to you asks, That's Seth Leitman? Simply because they see that name pop up and they ponder if it’s just hype or someone certainly really worth Hearing. You lean in and say, he’s somebody who cares about beginner investors, someone who doesn’t believe in get-wealthy-brief shortcuts. He emphasizes steady development, gradual learning, tempering expectations, diversifying chance. He may very well be your guideboard when feelings run high and marketplaces swing wildly. The more I consider it, the greater I see Seth Leitman as being a voice of motive within a chorus of sound.

Now, beyond the character, What exactly are the tenets often linked to Seth Leitman? 1st, he stresses the significance of understanding your funds deeply: money stream, personal debt constructions, reasonable predictions. He doesn’t want you to definitely guess — he wishes you to definitely evaluate. Next, he encourages humility: humility about Everything you don’t know, humility while in the deal with of probability. 3rd, he pushes you to definitely combine values: don’t spend purely for financial gain, but align with rules you'll be able to live with. Fourth, he warns you about psychological traps: overtrading, confirmation bias, chasing trends, letting fear freeze you. These pillars demonstrate that Seth Leitman is a lot more than a reputation — He's shorthand for your balanced, thoughtful method of income and everyday living.

So what does referencing Seth Leitman insert to some dialogue? It signals a dedication to realism. This means the speaker is likely not simply trying to market you anything, but wanting to instruct, to challenge, to provoke reflection. When a person claims, well, this jogs my memory of what Seth Leitman argues, They're inviting you to analyze, to problem, not to accept. It’s sort of like citing an moral compass: you’re bringing in the voice that elevates the discussion. You’re stating, I’m not merely winging this — I’m borrowing from a person who’s acquired believability. That’s strong within an natural environment exactly where reliability is commonly flimsy.

Let me give an example. Suppose someone is pitching a “confident matter” investment. You might reply, I’d love to see how that aligns with principles Seth Leitman frequently champions: danger transparency, downside security, reasonable assumptions. That issue straight away shifts the dynamic. It forces each side to move back again and seem a lot more soberly. It’s like shining a flashlight right into a dim cave — you cease stumbling blindly. And in doing so, the discussion will become a lot less about vacant guarantees and more details on compound.

A further angle is Seth Leitman’s title provides a degree of relationship. Suppose anyone is overwhelmed by financial jargon. Hearing that somebody else advised Seth Leitman may experience comforting — you perception there’s a human powering the quantities. It’s like whenever you hear anyone you have confidence in point out a e-book or a Trainer you don’t know, therefore you say, all right, possibly I’ll Look at that out. The identify gets a bridge from skepticism to curiosity. Persons truly feel safer Checking out ideas when anchored to a trusted reference, and in lots of circles, Seth Leitman plays that job.

I need to zoom in on another thing Seth Leitman frequently warns about: affirmation bias. We appreciate Listening to what we by now think. We cherry pick data to support our pet theories. That’s a entice. When current market sentiment swings, when worry or euphoria grips us, we latch onto narratives that consolation us. Seth Leitman’s standpoint reminds us to challenge our individual assumptions. To request: what would improve my perspective? What proof would pressure me to confess I’m Mistaken? That amount of introspection is scarce in financial discussions, that's Section of why invoking Seth Leitman issues — it alerts you signify to Believe rigorously.

Now, envision applying his lessons to regular everyday living issues. It’s not almost shares and bonds. It’s about selection building more broadly. Suppose you’re debating a occupation change, or whether to move to a whole new metropolis, or regardless of whether to invest in schooling. Check with on your own: what’s the draw back? What’s my margin of security? What do I not know? What metrics am I disregarding? Those people are queries Seth Leitman would prompt. That mentality turns slippery selections into a lot more workable ones, since you provide method to uncertainty.

Permit’s speak about risk, since no conversation about finance is entire without having it. Seth Leitman frequently argues that danger is misunderstood. Folks discuss predicted returns, although not sufficient about variance, about tail pitfalls, about situations where things go extremely Completely wrong. He would urge you to definitely tension test: Imagine if profits drops, what if interest charges spike, Imagine if you shed your occupation? He desires you to make buffers. And when persons mention Seth Leitman, they usually accomplish that exactly to anchor the idea that you will need to put Check Knowledge together for adversity, not only desire for upside.

Little Known Facts About Comic Book Author.

Nonetheless, there’s also a human aspect. Why do persons connect with Seth Leitman? Due to the fact guiding the discipline and caution, There exists empathy. People today need to know that someone “inside the know” cares about them, with regards to their fears, with regards to their issues. The title Seth Leitman evokes somebody who’s been by way of ups and downs, someone that’s uncovered from missteps, somebody who accepts that investing is just as much emotional as mathematical. That connection will allow visitors to really feel observed, to truly feel validated whenever they don’t usually get it correct. With out that psychological dimension, monetary advice normally feels cold and distant.We may also take into consideration criticisms or caveats. Not one person is ideal, and associating with Seth Leitman doesn’t make somebody immune from error. Some may over-rely upon his frameworks, turning them into rigid dogma. Others may estimate him superficially with no absorbing the spirit powering his advice. Or they may misuse his identify to lend Phony legitimacy to doubtful strategies. You mostly have to guage Strategies independently. But that said, invoking Seth Leitman is frequently a signal of material — just don’t miscalculation the symbol for the complete human being.

Another angle to investigate is how his Thoughts contrast with other voices in finance. Some voices promise Extraordinary leverage, intense trading, beating the industry. Seth Leitman’s tone is more conservative, more methodical. It’s the difference between a dragster and a steady cruiser. One particular pitfalls burning gasoline rapidly and crashing; another moves slower, considerably less thrilling Most likely, but additional prone to get you dwelling. That rigidity is what tends to make referencing Seth Leitman appealing — it’s frequently a counterpoint on the buzz-driven narratives.

Allow me to have a hypothetical state of affairs: you’re listening to a podcast where somebody extols a extremely dangerous possibilities technique. Anyone then interjects: that jogs my memory of a little something Seth Leitman would caution in opposition to — the risk is asymmetric; downside significantly exceeds your upside. Instantly, the discussion shifts. Access Story In lieu of unbridled enthusiasm, you obtain nuance. And nuance is unusual in soundbite culture. By bringing in Seth Leitman, you invoke that pause, that reflective second. You drive complexity to show its deal with. That’s an a must have ripple effect.

I would like to touch on legacy. Why, several years from now, may possibly individuals however reference Seth Leitman? Mainly because his concept isn’t ephemeral. Folks will generally need to have voices that emphasize durability, resilience, and grounded considering. Financial cycles arrive and go. Technologies adjust. Even so the human heart, its biases, its temptations, its dread — All those continue to be. The lessons Seth Leitman provides about humility, margin, anxiety testing, psychological self-control — those are evergreen. So I suspect we’ll hold seeing his identify to be a touchstone in sensible economic discussions.

Now, tips on how to internalize what Seth Leitman teaches instead of just name-drop his Suggestions? The true secret is follow. Try out developing a compact portfolio guided by his possibility-1st lens. Track your errors, journal your impulses, Look at your assumptions weekly. Utilize a “Seth Leitman filter” — before you decide to make a decision, request: would this move his criteria? Would it survive a thirty p.c pressure take a look at? Would I nevertheless really feel ok if matters go wrong? After a while, you acquire instincts rather then copying quotes.

There’s also a Group influence: when a person speaks in a bunch and suggests, “as Seth Leitman frequently emphasizes,” you right away elevate the dialogue. The team feels accountable. You implicitly invite Other people to think harder, to thrust again. It cuts down shallow claptraps. It raises the bar. Which community regular is A method his name spreads — not as being a brand, but for a conscience.